The third quarter 2019 financial report by insurance distributor Fanhua, Inc. revealed important developments at the Company as it navigates regulatory and competitive changes in China’s life, property and casualty insurance industry. The turnover in Fanhua’s sales force has slowed and productivity appears to have improved as the Company completes registration of its sales agents with the PRC insurance regulator. Management is well along with programs to expand and professionalize the sales force by recruiting insurance industry professionals and placing them in new territories in medium- and large-size cities in China. Their accomplishments bode well for growth in the coming years.

We continue to rate FANH shares at Buy with the view that the stock remains undervalued against its peer group. As noted in the Valuation section of this report, a peer group of China-based financial services firms are trading at 29 times trailing earnings, well above the 19.6 trailing multiple at which FANH currently trades. In our view, investors should take advantage of the current undervaluation to take long positions in FANH shares. We expect earnings reports in the coming year to provide strong comparisons in sales and earnings as the Company’s expansion plans take hold. We also expect news of that expansion to lead a favorable change in sentiment toward Fanhua’s prospects.

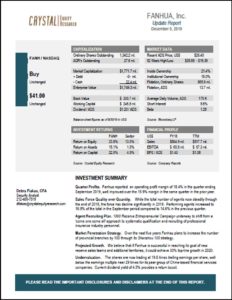

For additional details in the full 12-page report click on the image below.

Please note the important disclosures and disclaimers at the end of every Crystal Equity Research report.