Fanhua’s financial report for the fourth quarter 2019, confirmed that the China independent insurance agency closed out the year 2019 with strength. Yet, all eyes and ears were on management’s guidance for the first quarters in 2020, and the impact on sales and earnings by government policies as China grapples with an outbreak of a new and deadly virus. During the earnings conference call following announcement of financial results, management disclosed that so far no employees had contracted the virus. The excellent track record may largely be due to the capacity of Fanhua’s online-to-offline business model that has allowed the Company to quickly shift agent recruiting, sales training, customer acquisition, and customer service to virtual channels on digital platforms. We believe Fanhau’s is better equipped than many in the China consumer financial services market to cope with current interruption of conventional business activity. In our view, that makes Fanhua a strong candidate for a long-term investment.

Management allows that sales of some life insurance products involving significant investment often require an in-person meeting, but that other, less complex policies can be easily handled with virtual presentations and digital payments. Consequently, management’s guidance for the first quarter ending March 2020, is quite optimistic at least RMB 50 million (US$7.2 million) in operating income.

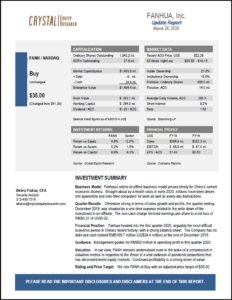

Management’s confidence that Fanhua can remain profitable even during a period of unprecedented economic upheaval in its target market informs the reiteration of our Buy recommendation for FAHN. That said, our target price is reduced to US$35.00 (from US$41.00) based on revised earnings expectations and an unfavorable shift in valuation metrics. Management guidance is lower than our estimates going into the earnings report, but our assumptions and figures had been formulated far ahead of any news of a potential health crisis in China. Our earnings model for 2020 now reflects some negative impact from the economic slowdown in China at least through the third quarter. Second, a reduction in appetite for risk is to be expected to prevail for some months to come. Consequently, we expect valuation metrics to remain suppressed in the near-term.

Contact us at info@crystalequityresearch.com for a copy of the full report.

Please note the important disclosures and disclaimers at the end of every Crystal Equity Research report.